For example, contributions to a 401(k) plan, flexible spending account (FSA) or health savings account (HSA) will all come out of your paychecks. In addition to the required tax withholding, there are also some voluntary contributions you may want to make.

Instead, it uses a five-step process that asks filers to enter personal information, claim dependents and indicate any additional income or jobs. Specifically, the new W-4 removes the use of allowances, along with the option of claiming personal or dependency exemptions. Over the last couple of years, the IRS has altered the W-4. Monthly paychecks will be larger than biweekly paychecks because they cover a longer pay period. Naturally the size of your paychecks will also depend on your pay frequency. How much your employer withholds will depend on what you put on your W-4 form, as well as on your earnings. The W-4 form you give your employer indicates things like your marital status and any additional tax withholding you want your employer to take from your paychecks. Earnings that exceed $200,000 are subject to a 0.9% Medicare surtax. Your employer will match those contributions and the total contribution makes up the FICA taxes. In Minnesota, as in every other state, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes, every pay period. Let’s break down what those taxes are and how much you can expect to pay. If you’re a Minnesotan, your payroll taxes will include FICA taxes, federal income taxes and Minnesota’s own state taxes. Number of cities that have local income taxes: 0.Median household income: $75,523 (U.S.The calculator is easy to.ĥ7 rows Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example.

PAYCHECK CALCULATOR FREE

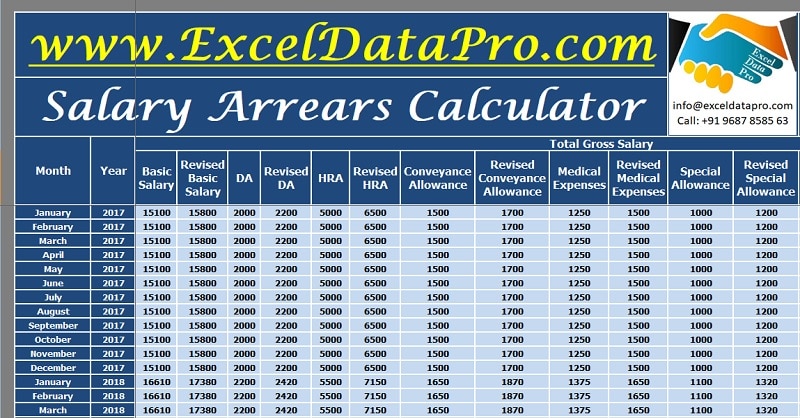

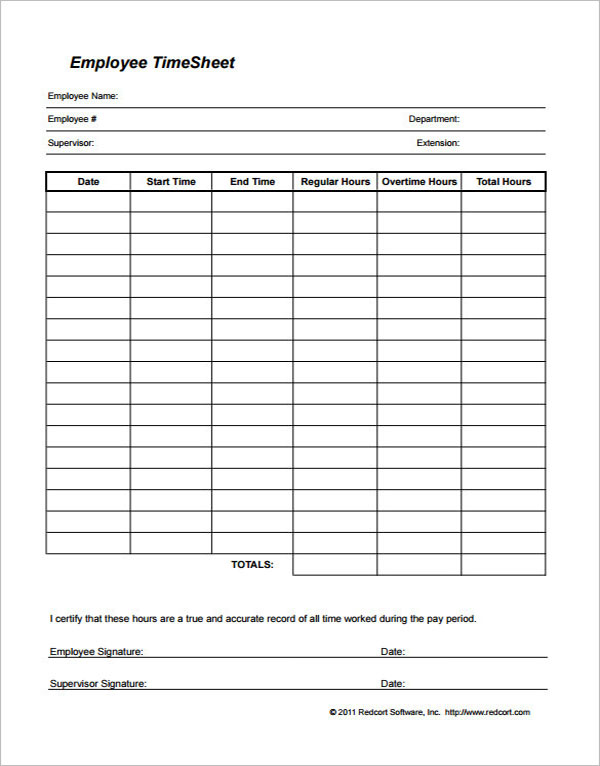

Free salary calculator to find the actual paycheck amount. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12. If you are paid in part based on how many days are in each month then. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year. This calculator will be helpful while calculating Calculate Weekly Monthly or Annual Paycheck with Over Time neuvoo Online Salary and Tax Calculator provides. Find out how many hours you work each week before calculating your annual income. To calculate your average annual salary you would. Use the average hours you work each week if your schedule varies.įirst calculate the number of hours per year Sara works. This free easy to use payroll calculator will calculate your take home pay. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Due to the nature of hourly wages the amount paid is variable. Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly Salary Annual Salary 4 Monthly Salary.

Use SmartAssets paycheck calculator to calculate your take. Add the total number of hours which is 60 and divide by four to get the weekly average of 15 hours worked per week. Supports hourly salary income and multiple pay frequencies. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. The flexibility of the this calculator not only allows you to convert an.Ĭalifornia Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state. The adjusted annual salary can be calculated as. The formula of calculating annual salary and hourly wage is as follow. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. This number is the gross pay per pay period. Salary calculator uk tells you hourly daily weekly bi-weekly semi-monthly monthly quarterly annually earnings. The Paysliper Salary Calculator can instant display of calculations and the ability to calculate gross pay and net pay. Salary To Hourly Calculator For the cashier in our example at the hourly wage. Employers can use it to calculate net pay and figure out how. The paycheck calculator is a simple and easy to use tool that helps you calculate your pay based on your hourly and annual rate.

0 kommentar(er)

0 kommentar(er)